NBFC Voice Automation: Why It Is Becoming a Core Operating Layer in 2026

NBFCs have grown aggressively over the past ten years. Digital onboarding, instant disbursals, alternative credit scoring, and mobile-based journeys have enabled NBFCs to grow at a pace that is faster than traditional banks. However, while customer acquisition and servicing have become digital, one layer of operations has remained manual.This layer is voice.Voice remains the most popular channel for EMI reminders, collection follow-ups, borrower inquiries, repayment confirmations, and dispute resolutions. As loan portfolios expand, voice calls rise exponentially, creating pressure on costs, manpower, and the customer experience. This is why voice automation for NBFCs is no longer a nice-to-have but a necessity.

What Is NBFC Voice Automation?

NBFC Voice Automation is the application of AI-driven voice technology to handle borrower calls without having to depend solely on human resources. This technology is intended to deal with repetitive, high-volume, and time-sensitive voice conversations.

Unlike traditional IVR systems, NBFC Voice Automation is conversational and contextual. It not only directs calls but also interprets the borrowers’ intent, reacts accordingly, and performs pre-defined tasks such as recording results or sending reminders. The aim is to achieve efficiency without sacrificing compliance.

In essence, voice automation helps NBFCs handle borrower communication on a large scale without increasing the cost of collection or the burden on human resources.

Why Traditional Voice Operations Are Breaking in NBFCs

The traditional voice operations in NBFCs are highly reliant on human resources, staffing, and outsourcing. As the number of borrowers rises, the demand for voice channels also rises linearly.

This approach will become unfeasible as the number of digital loans rises exponentially, but the growth in voice channels is slow. This leads to longer waiting times, repeated calls, lower resolution rates, and higher costs of operations. The loan agents are left with no choice but to deal with regular calls that do not add much value.

This is not a matter of temporary staffing; it is a matter of design limitations. Voice operations cannot scale up at the same rate as NBFCs without automation.

Is AI Replacing NBFC Teams?

AI is not replacing NBFC teams. AI is replacing manual repetition.There is still a need for human judgment in NBFC operations like negotiations, disputes, escalations, and compliance. AI voice solutions are built to automate predictable and rule-based interactions like reminders, confirmations, and queries.

AI is removing repetitive work, and this will enable human agents to work on complex and sensitive borrower interactions. This will help in improving productivity and employee morale while ensuring regulatory control.

How AI Voice for NBFC Changes Operations

1. From Dialing Lists to Intent-Driven Conversations

Conventional NBFC collections involve static call lists and scripted conversations. The agents call the borrowers without any real-time context, resulting in generic conversations and pushback.

AI voice assistants start conversations based on the borrowers’ intent, such as due dates, payment behavior, or past responses. This approach ensures that the conversations are contextual, timely, and less invasive. The borrowers are more likely to respond when the conversation feels less mechanical

2. From Reactive Calls to Structured Follow-Ups

Follow-ups are usually missed by manual teams because of volume pressure and human error. AI voice automation ensures that reminders, acknowledgments, and confirmations are made on a consistent basis and on time.

This design eliminates missed interactions and ensures that communication policies are adhered to. Human agents are brought into play only when the scenario calls for negotiation or empathy, thus enhancing the efficiency of collections

3. From Linear Cost Growth to Scalable Voice Operations

In conventional models, the cost of voice goes up directly in proportion to the volume of calls. With more borrowers, there are more agents, higher vendor charges, and higher attrition rates.

Voice automation using AI technology makes cost independent of volume. The voice business scales digitally, and NBFCs can expand their loan books without a corresponding rise in voice costs.

4. From Fragmented Systems to Unified Borrower Context

Without automation, the data of the borrowers is dispersed in the CRMs, loan management systems, and agent notes. This causes the borrowers to repeat themselves, and it takes longer to resolve.

The AI voice solutions connect seamlessly to the backend systems, providing a holistic view of the borrowers. The calls are automatically recorded, and the agents have complete context when they escalate.

Why IVR Alternatives for NBFCs Are Critical

IVRs were intended for call routing, not handling borrowers. IVRs are not suited for real-world NBFC scenarios like EMI complaints, partial payments, and commitment delays.

Every IVR call is a new context, making borrowers repeat themselves. This leads to more abandonment and repeat calls. More IVR menus are not a solution; they are a problem.

The IVR solution for NBFCs needs to be conversational, contextual, and able to perform actions, not just route calls

What Is GenAI Voice in the NBFC Context?

GenAI Voice Agents employ the use of generative AI to produce dynamic and natural-sounding responses rather than choosing pre-defined scripts. This enables the conversation to be dynamic depending on the intent of the borrowers and past conversations.

In NBFC applications, GenAI facilitates multi-step conversations such as reminder → explanation → confirmation without having to reconnect the call. This is because retaining context makes conversations smoother and more natural-sounding.

GenAI, when controlled and managed well, enhances consistency and minimizes errors resulting from agent fatigue.

Core Technologies Behind NBFC Voice Automation

1. Automatic Speech Recognition (ASR)

ASR translates borrower speech into text. In NBFCs, accuracy is paramount since borrowers may speak in mixed languages and regional accents. Inaccurate ASR results in misunderstandings and a breakdown of trust.

Accurate ASR translates to effective intent detection and a smooth conversation flow, particularly in the Indian NBFC setting.

2. Natural Language Understanding (NLU)

NLU identifies the intent of the borrower, which may not be what they are saying. The intent could be payment delay, dispute, or confirmation.

The accuracy of NLU enables AI to route conversations and select response flows. This eliminates unnecessary escalations and improves the quality of resolution.

3. Generative AI (GenAI)

Gen AI allows for contextual and adaptive responses. Rather than using scripted responses, the responses are generated dynamically while remaining within approved parameters.This allows for greater borrower engagement without sacrificing control.

4. Backend Integration

Voice automation has to be integrated with loan platforms, CRMs, and payment gateways. If it is not integrated, AI voice will only be able to deliver information.

With integration, it is able to log results, update statuses, and initiate workflows, making it more operationally relevant

5. AI Governance and Confidence Scoring

Governance makes AI safe for use. Confidence Scoring identifies when there is ambiguity and escalates to human agents if necessary.This is safer than manual processes because it is not unmanaged.

NBFC Voice Automation in Collections

The most impactful use case for NBFC voice automation is Collections. AI voice solutions can send EMI reminders, confirm payments, and record borrower responses.

It prevents missed follow-ups and allows agents to concentrate on complex cases. In the long run, it reduces cost-to-collect and enhances recovery predictability.

NBFC Customer Support Automation

It also deals with borrower support inquiries like loan status, disbursal confirmations, and statements.This decreases the volume of incoming calls and enhances the response time. Borrowers get immediate responses, and agents are left with exceptions.

Human + AI: The Right Operating Model for NBFCs

Effective NBFCs do not replace agents but redefine their roles. AI takes care of the repetitive and scalable part, and humans concentrate on the judgment and empathy aspects.

This approach leads to better recovery results, agent satisfaction, and customer trust. It is the only scalable solution for a high-volume NBFC setup.

AI Governance in NBFC Voice Operations

NBFCs function under intense regulatory oversight. AI voice solutions need to ensure complete audit trails, script compliance, and escalation facilities.

Regulated AI minimizes the possibility of errors and ensures that all processes are uniformly executed, thus making it safer to operate at scale.

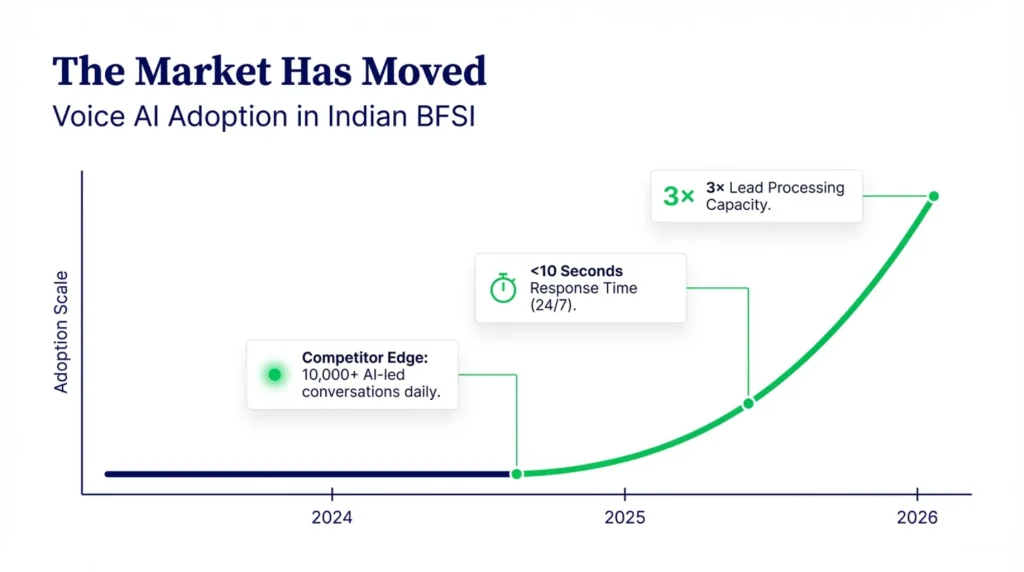

Why NBFCs Are Adopting Voice Automation Now

The expectations of borrowers are shifting. The ability to have instant and conversational responses is no longer a luxury but a necessity.

NBFCs that have adopted voice automation are now able to reduce operational stress, manage costs effectively, and scale smoothly. However, delayed adoption will result in increased costs and deteriorating borrower experience.

Voice-First NBFC Operations: The Future

Voice is no longer a support function. Voice is becoming the infrastructure for the NBFC.

The NBFC voice automation solution will enable predictable growth, improved compliance, and enhanced engagement with borrowers.

Watch the Full Video

Final Thought

Voice automation in NBFCs is not innovation anymore. It’s operational hygiene. NBFCs that transform voice today will scale sustainably.Those that don’t will continue to increase cost without increasing capacity

Frequently Asked Questions (Faqs)

Q1.What is NBFC voice automation?

Voice automation in NBFCs is the application of AI-driven voice technology to manage borrower interactions such as EMI reminders, collection follow-ups, payment confirmations, and general support queries.

These technologies are conversational, have the ability to understand borrower intent, and are capable of executing predefined tasks by interacting with backend systems.Unlike IVRs, voice automation is centered around resolution and not just routing.

Q2. Is AI voice automation compliant for NBFCs?

Yes, AI voice automation can be fully compliant when it is implemented with proper governance. Enterprise-grade systems operate within approved scripts, have complete call recordings and transcripts, and offer audit-ready logs.

They also have confidence scoring and automatic escalation for sensitive or ambiguous calls. This makes governed AI voice systems often safer than manual operations under scale pressure.

Q3.Will AI voice replace collections or support agents in NBFCs??

No, AI voice does not replace NBFC agents. It replaces repetitive, low-complexity tasks such as reminders, confirmations, and routine queries.

Human agents will continue to handle negotiations, disputes, escalations, and high-empathy conversations. The model is AI for scale, humans for judgment, not replacement

Q4.How is AI voice different from IVR systems?

IVR systems are based on fixed menus and keyword routing. AI voice systems are able to understand natural language, retain context, and respond dynamically.

IVRs lose context at every step, while AI voice systems handle conversations end-to-end.Repeat calls, borrower frustration, and costs are reduced

Q5 Which NBFC use cases benefit most from voice automation?

The most impactful use cases are: EMI reminders and follow-ups Payment confirmations and acknowledgements Loan status and due date queries Regular borrower support

First-level collections interactions These use cases are high volume, time-bound, and rule-based, making them perfect for automation using AI.

Q6.How does NBFC voice automation reduce cost-to-collect?

Cost-to-collect is minimized by voice automation because it can handle a high volume of routine calls without the need for human involvement.

Missed follow-ups are eliminated, and there are fewer repeat calls because of voice automation.

Human teams are only concerned with complex or high-risk accounts. Eventually, the cost of operations is reduced while the efficiency of recovery is improved.

7. Can AI voice handle regional languages and mixed speech?

Yes, contemporary AI voice technology allows for multilingual and mixed-language conversations, such as Hindi-English and regional accents.

This is particularly important for Indian NBFCs with geographically dispersed borrower bases. High-quality speech recognition enables accuracy without compelling borrowers to commit to strict language options. This enhances borrower engagement and response rates.

8.What happens if the AI is unsure or the borrower becomes emotional?

Enterprise-level AI voice assistants employ confidence scoring to identify uncertainty, stress, or ambiguity in the user’s voice. When the thresholds are breached, the call is automatically escalated to a human agent.

All context is shared with the human agent, ensuring that there is no loss of information. This ensures that sensitive scenarios are always handled by a human.

9. How long does it take to implement NBFC voice automation?

The time taken for implementation differs depending on system integration and use cases. For specific use cases such as reminders or confirmations, the implementation process can start in weeks.

Most NBFCs begin with a controlled pilot and then scale up gradually. This helps in avoiding risks and ensuring a smooth adoption process.

10. Is NBFC voice automation suitable for small and mid-sized NBFCs?

Yes. Voice automation is not only for large NBFCs. Mid-sized NBFCs can greatly benefit since automation enables them to scale without having to hire many people.

Cloud or private cloud-based solutions enable flexible scaling based on the volume. The trick is to begin with high-impact and repetitive scenarios.

11. Does AI voice automation increase borrower complaints?

If done properly, it normally decreases complaints. Customers get quicker responses, consistent answers, and less repetition of calls.

Escalation procedures are put in place to ensure that humans deal with sensitive issues.Complaints are mostly generated by poor IVR experiences and not conversational AI.

12. Is voice automation safe for collections and regulatory scrutiny?

Yes, when governed properly.

All interactions are logged, auditable, and policy-driven.

AI executes approved workflows consistently, without fatigue or deviation.

This makes compliance management easier at scale.