Smart AI Solutions for NBFC & BFSI

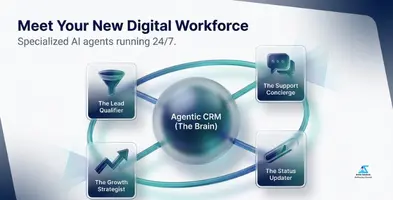

Create a team of specialized AI agents that run 24/7 to assist with loan processing, customer service, EMI reminders, as well as collections. You would thereby liberate your team of employees to do what you employed them for: growing your business.

Your next hire isn’t human. These teams know.

Archiz AI Solutions for Lending

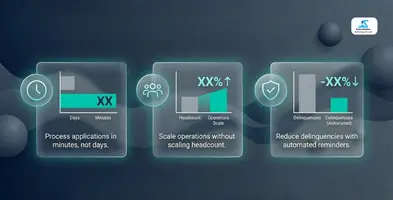

Archiz AI Solutions provides intelligent and automation solutions for advanced NBFCs and BFSIs. Archiz AI voicebot responds to every customer call with natural conversations, AI agent processes loan applications within minutes, conducts real-time KYC verification, sends automated reminders for EMI payments via calls, SMS, and emails, and agentic CRM routes qualified leads to your team while providing the entire history. These are highly suitable for consumer lending, microfinance, housing finance, and vehicle financing organizations seeking to enhance their loan processing capabilities, faster recoveries, reduced delinquencies, and release more time for business development.

A Specialized Agent for Every Lending Function

AI Voicebot for Customer Engagement

Answers questions about loan status, EMI dates, document requirements, and payment methods in Hindi, English, and regional languages.

AI Agent for Automated Operations

Processes loan applications, verifies KYC documents, checks credit scores, validates bank statements, and creates complete application files — all automatically in minutes.

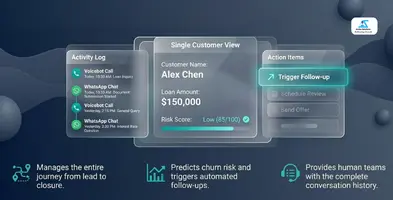

Agentic CRM for Smart Customer Management

Manages entire customer journey from lead to loan closure. Automatically triggers follow-ups, sends EMI reminders, identifies cross-sell opportunities,predicts churn risk.

Automated EMI Reminder System

Calls every customer before EMI due date, sends personalized reminders, shares payment links, and escalates overdue accounts to collection team automatically.

Instant KYC & Document Verification

Verify Aadhaar, PAN, bank statements, salary slips, and other documents. Checks against government databases and flags mismatches automatically.

Automated Compliance & Audit Trail

Ensures all processes follow RBI guidelines. Records customer consents, maintains audit logs, generates compliance reports, and alerts for policy violations.

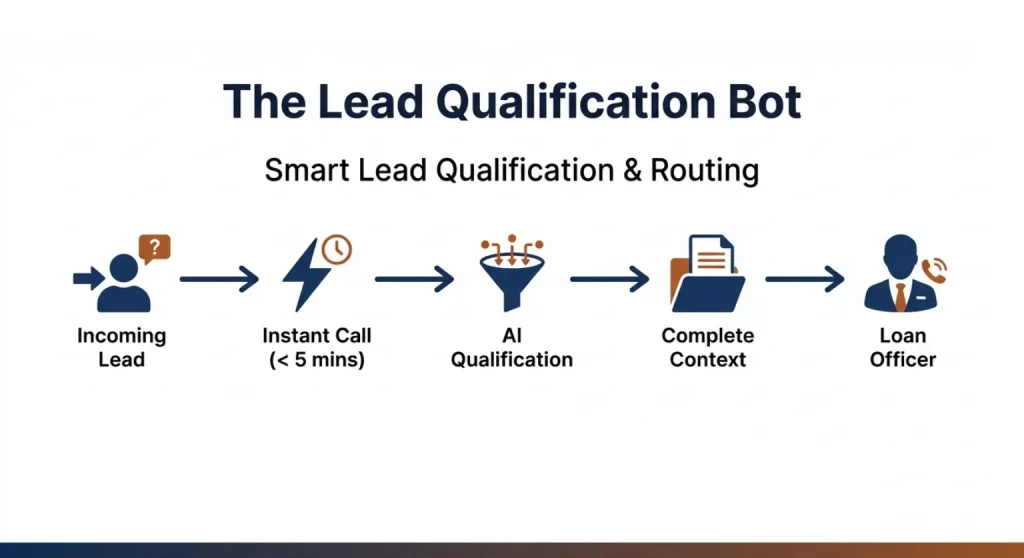

Smart Lead Qualification & Routing

Calls new leads within minutes, understands requirements, checks basic eligibility, qualifies interest level, and routes to right loan officer with complete context.

24/7 WhatsApp & Website Support

Answers customer questions on WhatsApp and website instantly. Provides loan information, shares payment links, explains procedures, and escalates complex queries to humans.

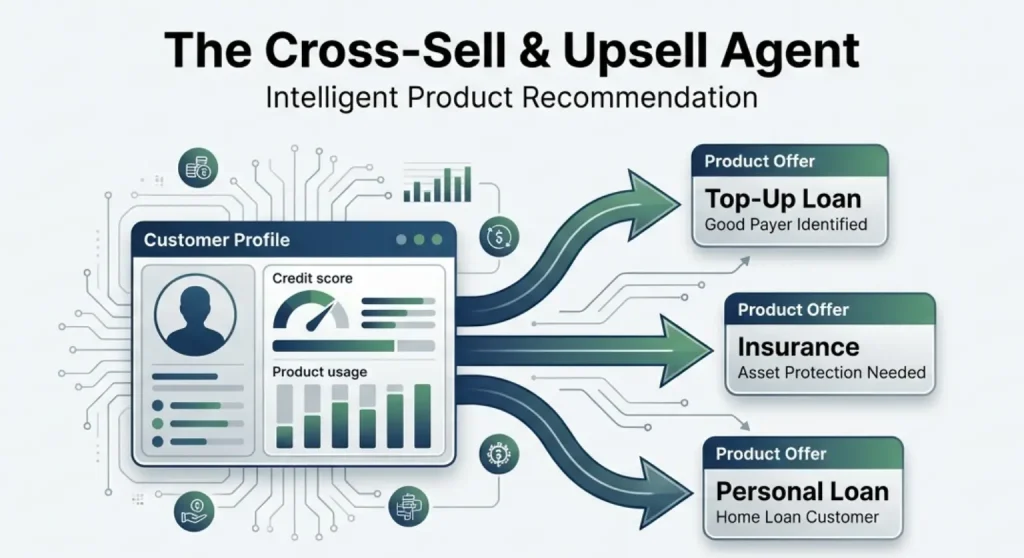

Intelligent Product Recommendation

Analyzes customer data to identify who needs additional products. Suggests personal loans to existing home loan customers, top-up loans to good payers, and insurance products automatically.

Real-Time Application Tracking

Keeps customers informed about their application status. Sends automatic updates when documents are verified, credit is checked, and approval is given. Reduces inquiry calls.

A Specialized Agent for Every Business Need

AI Solutions for Different NBFC/BFSI Types

Consumer Lending

Perfect for personal loans, consumer durables financing, and digital platforms.

Solutions:

- Instant application processing

- Digital KYC

- Quick disbursement

- Automated collections

- Customer support bot

Housing Finance

Designed for home loan companies and mortgage lenders.

Solutions:

- Property document verification

- EMI management

- Pre-closure handling

- Top-up loan automation

- Compliance tracking

Vehicle Finance

Built for auto loan and two-wheeler finance companies.

Solutions:

- Dealership integration

- RC verification

- Insurance renewal reminders

- Repossession management

- Customer engagement

Frequently Asked Questions

Will the AI voicebot sound robotic?

No. Our artificial intelligence system employs cutting-edge natural language technology. Yes, archiz artificial intelligence system speaks fluently in a number of Indian languages. Most customers don’t realize they’re interacting with an artificial intelligence.

What if AI cannot handle the query?

AI sends complex questions directly to your team instantly and will share the entire conversation history. You get to decide when the AI transfers the calls.

Is our customer data safe?

Yes. We adopt ISO 27001 security standards. Our data is stored only in India. Data is encrypted. RBI norms are also followed. An NDA is part of our process.

Can it function with our loan software?

Yes. We integrate with all major loan management systems and custom platforms through our APIs. We do this as part of our planning process.

Frequently Asked Questions

No. Our artificial intelligence system employs cutting-edge natural language technology. Yes, archiz artificial intelligence system speaks fluently in a number of Indian languages. Most customers don’t realize they’re interacting with an artificial intelligence.

AI sends complex questions directly to your team instantly and will share the entire conversation history. You get to decide when the AI transfers the calls.

Yes. We adopt ISO 27001 security standards. Our data is stored only in India. Data is encrypted. RBI norms are also followed. An NDA is part of our process.

Yes. We integrate with all major loan management systems and custom platforms through our APIs. We do this as part of our planning process.

Start your free trial today.

Let no customer call go unanswered. Automate your loan processing with intelligent AI. Process more applications, collect better, and grow faster.